Having spent a month now in New Orleans, I found that there aren’t many places that wear their history on their sleeves the way New Orleans does. A rich and difficult history stretching over hundreds of years, making it a place where a constant and often painful dialogue with past is present. A past that is still hard to deal with while simultaneously informing its rich culture. Throughout my stay here at the Deltaworkers this history presented itself to me in very real and visceral ways.

Connected, but less viscerally present, is perhaps the role New Orleans and Louisiana played in the development of our current financial system. New Orleans served as the ‘subject of investment’ of what we might call the first modern financial bubble in history. As it turns out, the founding of New Orleans has a peculiar relationship to our current global economic system.

To understand this we have to go back to the year 1716. Louisiana was already under French rule, but the city itself, New Orleans was yet to be founded. The Louisiana territory stretched out all the way in the Mississippi River valley of North America and was believed to be full of potential, ready to be discovered and mined for resources. By that time the french economy was in ruins. The wars waged by Louis XIV left the country completely wasted, both economically and financially. France was desperate for an answer, and in 1716 the John Law, a Scottish economic theorist, and financial wizard established the Banque Generale in France. Law proposed to stimulate industry by replacing gold with paper credit, increasing the supply of credit, and to reduce the national debt by replacing it with shares in economic ventures.

So under the control of Law the Banque General obtained the authority to issue notes. A decision Influenced by the time John Law had spent in Amsterdam. During his time there he was impressed by the share system of the Dutch East Indies Compagnie and the Bank of Amsterdam. He noted its contribution to the prowess of the Dutch in their trade and commercial endeavours, (despite having no more natural advantages than for instance his native Scotland). Furthermore The Bank of Amsterdam had created an internal system where merchants could settle their accounts by direct cashless transfer. Although impressed John Law simultaneously felt the system fell short – The Bank of Amsterdam never issued bank notes to the public.

Determined to improve this Law concocted a breathtaking modification of the financial institutions he had encountered in Amsterdam, combining the properties of a monopoly trading company like the Dutch East-Indies Company and a public bank. If these were in place the sky would be the limit, or so he thought.

Law had moved to France and had worked his way up in French society which was run at that time by the Duke of Orléans, who functioned as a regent for the youthful king Louis XV who was not yet of ruling age. With the support of the duke, Law was ready to unleash a whole new system of finance on a unsuspecting nation. A year after they founded the Banque Generale, they established the Compagnie de l’Occident which obtained the exclusive privileges to develop the vast French territories in the Mississippi River valley of North America. New Orleans, named to flatter the susceptible Duke of Orléans, was to become the flourishing harbor town trough which all the goods would be exported to Europe. Law’s company soon monopolised the French tobacco and African slave trades. By 1719 the Compagnie des Indes, as it had been renamed held a complete monopoly of France’s colonial trade. Law took over the collection of French taxes and the minting of money and in effect controlled both the country’s foreign trade and its finances.

Frenchmen regardless of rank were encouraged to buy shares into the new company. In Law’s vision the whole nation of France would become a body of traders. The huge profits would come from the development of Louisiana, which he projected as a garden of eden, taking the success the dutch east-indies as an example. The stockprice of the Compagnie des Indes soared. Scenes of frenzy took over the streets of Paris and a classic stockmarket loop unfolded – the more expansive the share price became, the more people wanted to buy them.

However, to pay out the returns promised to the first buyers of shares, Law could not use the profits of the company as these were yet to be made. He instead used the money earned by selling even more shares, while simultaneously pumping more money into the economy through his Banque Generale. France was in the grip of a mania.

Meanwhile in Louisiana the new colony still lacked settlers. As the frenchmen were more interested in stockmarket speculation than colonisation, John Law recruited men from the franco-german borderlands to colonise Louisiana. Several thousands of bold germans signed up and set sail to the promised land. But Louisiana did not turn out to be the land of riches that John Law had painted it to be. Instead they ended up in a insect infested swamp and it turned out that the monopoly in trade with Louisiana was worthless. Soon rumors started to circulate in Paris and the share price started to drop, rapidly. Angry crowds started gathering at Law’s bank. And by December, only a month after the stocks had launched, the shares had lost more than 90 percent of their value. The Mississippi bubble had burst.

The anger of the crowd started to direct itself towards Law and he was forced to flee the country and soon became europe’s most hated man. Not only did the Mississippi Bubble take down the French economy but it took the rest of Europe with it. The world’s first global stock market bubble had suddenly burst and along with it destroyed the dreams and fortunes of speculators in London, Paris, and Amsterdam overnight. Law became the subject of ridicule and mockery as he became the posterboy for everything that was perceived to be wrong about speculation within this new stockmarket system.

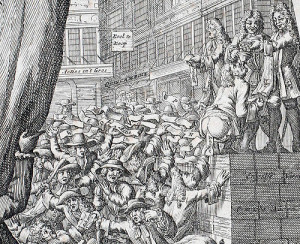

A document that seems to be a perfect testament to this can be found in the Williams Research Centre here in New Orleans – a book of Dutch of satirical prints, plays, poetry, commentary, and financial prospectuses entitled Het groote Tafereel de Dwaasheid (The Great Mirror of Folly). Flicking through the book one can see scenes of desperate tradesmen holding up signs containing cries of help. A Devil who by means of bellows inserted into the rectum of a trader, inflates him to the point where he starts to vomit share-papers over a cheering crowd. The drawings are as dense as they are crude and filled with an incredibly dark sense of humour. We see John Law triumphantly feeding a desperate man while he simultaneously shits stock papers over a frenzied crowd. It is perhaps the first document to so viscerally depict the anger towards the failure of a financial system. It perfectly illustrates the folly and misfortune of speculators in a unique and lavish record of the financial crisis and its cultural dimensions. The book presents incredibly effective metaphors. Stocktraders are consequently named is ‘windverkopers’ and “windkopers” which translates as windsalesman. Referring to the wind that is necessary for the boats to make trade possible, while at the same time referencing the game of gamble and the empty promises of John Law.

I cannot help but draw a curious parallel in these metaphors when thinking about the role of wind in the economy, when considering New Orleans. As Katrina it blew away the homes and lives of people it simultaneously paved the way for a wave of privatisations while citizens were too emotionally and physically distracted by the disaster. A logic that perhaps sound too crude, but is perfectly exemplified by the article Milton Friedman wrote for the Wall Street Journal only weeks after Katrina. In this article called The Promise of Vouchers’ he wrote that the chaos hurricane Katrina left behind, offered the perfect opportunity to privatise the school system. To this the Friedmanite American Enterprise Institute would later add “”Katrina accomplished in a day what Louisiana school reformers couldn’t do after years of trying”. The logic not only effected the school system but for instance also the public housing, of which large parts were replaced with mixed income housing with Goldman & Sachs being one its main investors. Perhaps it is fruitful to attempt to connect this history of New Orleans and the criticism and metaphors present in Het Groote Tafereel der Dwaasheid, to understand the current tenets of capitalism in relation to the changes it engendered in post-katrina New Orleans.

To be continued…